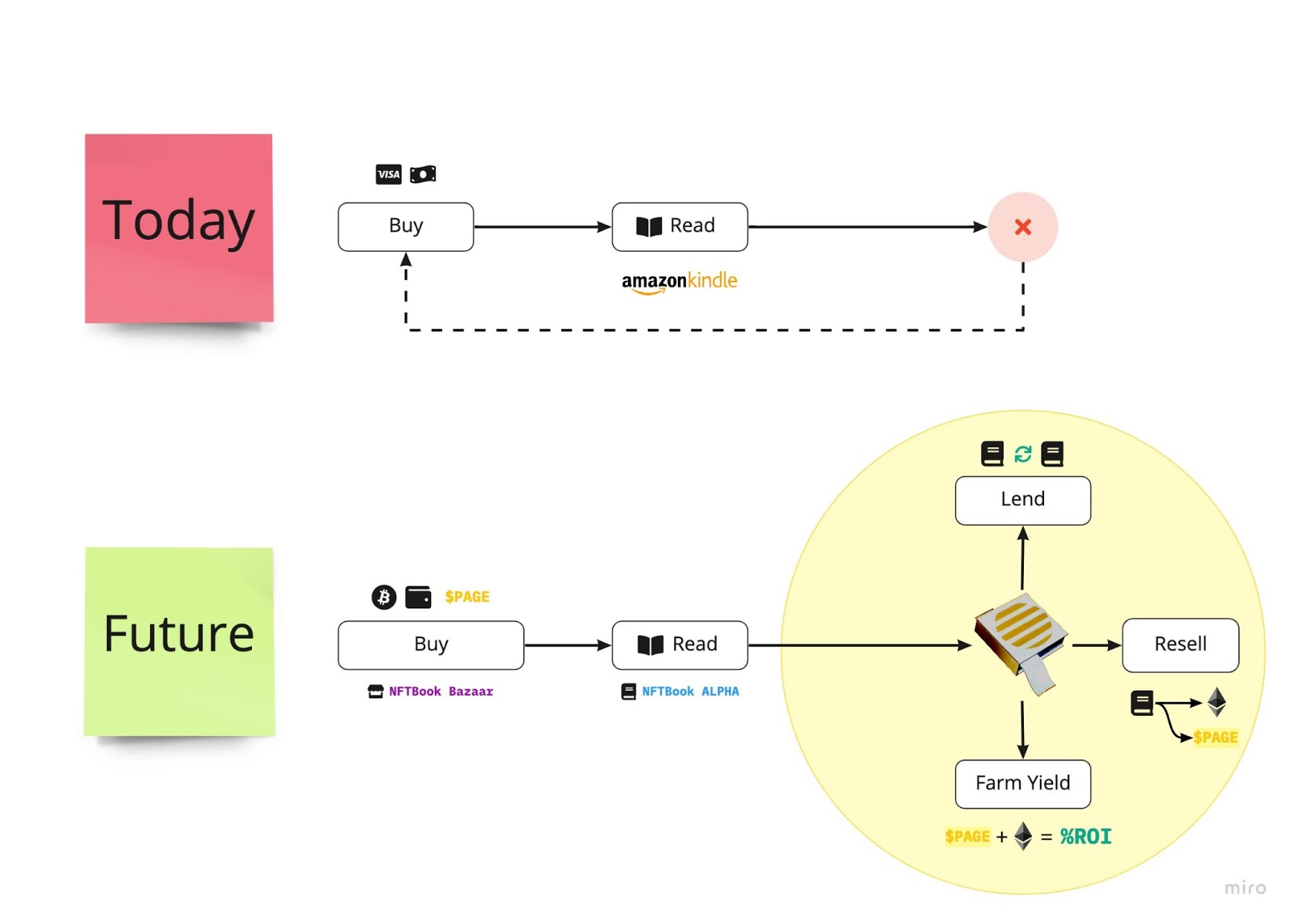

NFTBook Liquidity Pool Structure

NFTBook Liquidity pools will be used to issue NFTBooks into the marketplace at a Target Price (TP) set by vote by quorum of LP DAO members (Each is ultimately a blockchain-based publishing house that issues NFTs instead or in addition to printed physical books). The liquidity pools will feature a PAGE token with which any given NFTBook can be paired. The TP is enforced by the minting of additional assets as required by the market to keep the price of any individual asset beneath a given threshold, thus automatically pairing increased supply to increased demand for an asset or by depositing excess PAGE tokens from the LP into the wallets of LP Token holders on the basis of the % of the LPT held by each individual. Undesired price decreases can be mitigated by similarly burning assets or depositing additional PAGE tokens into the pool.

How NFTBook LPs Start#

To create a liquidity pool, a ratio of PAGE tokens to NFTBooks (target price) must be defined (it can later be changed by the LP DAO). A number of PAGE tokens and NFTBook tokens equivalent to this ratio must be deposited into the pool. The depositing address will receive in return LP Tokens (LPTs) which will qualify the holder to call votes regarding proposals of particular sorts of actions (deposit and/or withdraw PAGE from all LPT-holding wallets, change TP, etc) and vote or delegate voting privileges to another address.

Benefits of PAGE Token Usage#

PAGE tokens will enable users to purchase NFTBooks at a discounted price vs other accepted cryptocurrencies (interoperability facilitated by Starname and IBC technology) and will provide a means by which to compensate Validators on the PAGE network to keep the PAGE state machine online.